This article will use PYTHON drawing In bitcoin (BTC) For example Drawing analysis ( Xiaobaixiang )

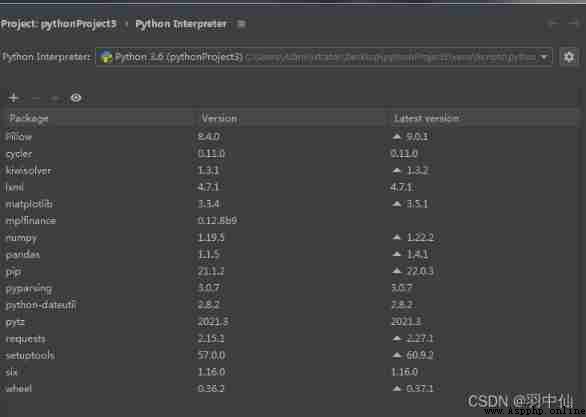

Pycharm Platform compilation

import requests

from lxml import etree

import math

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

from mplfinance.original_flavor import candlestick_ohlc

from matplotlib.pylab import date2num

import datetime

Data from abroad coinmarketcap( You need to go online scientifically ) To extract 2021.2.1-2022.2.3 The data of

coinmarketcap

https://coinmarketcap.com/currencies/bitcoin/historical-data/?start=20210101&end=20220202)

I put the data directly into the network disk , How can you climb behind me and mend it ( But it's no use being an overachiever. You don't have to know anything about it )

link :https://pan.baidu.com/s/1C3np-mnd-AAX_4u3XlnZ_A

Extraction code :7bxn

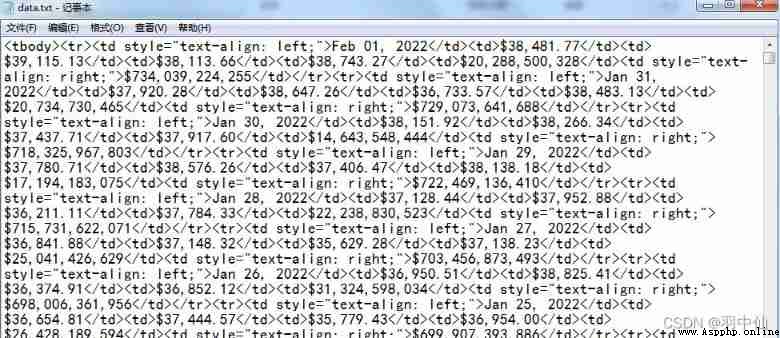

Crawling is HTML Format , The following code is transformed

The data includes 7 Elements

‘date’: date

‘open’: Opening price

‘high’: The highest price of the day

‘low’: The lowest price of the day

‘close’: Closing price

‘volume’: Total trading volume of the day

‘Market Cap’: Market value of the day

with open("data.txt", "r") as f: rd = f.read()

selector = etree.HTML(rd)

url_infos = selector.xpath('//tr')

data = []

for url_info in url_infos:

l = []

for i in range(7):

d = url_info.xpath('td[%d+1]/text()' % i)

if i == 0:

l += d

else:

if d[0] == '-':

d[0] = np.nan

l += d

else:

d[0] = d[0].replace(',', '')

d[0] = d[0].strip('$')

d[0] = float(d[0])

l += d

data.append(l)

arr = np.array(data)

df = pd.DataFrame(arr)

df.columns = ['date', 'open', 'high', 'low', 'close', 'volume', 'Market Cap']

df = df.astype({

'open': 'float64', 'high': 'float64', 'low': 'float64', 'close': 'float64', 'volume': 'float64', 'Market Cap': 'float64'})

df = df.reindex(index=df.index[::-1])

df.head() # In reverse order

df.reset_index(drop=True, inplace=True) # After reverse order reset index

df.reset_index(inplace=True) # reset index, The original index Remittance DataFrame in

df['date']=pd.to_datetime(df['date'])

df = df.astype({

'date': 'string'})

df.index = pd.to_datetime(df['date']) # Set up index Value

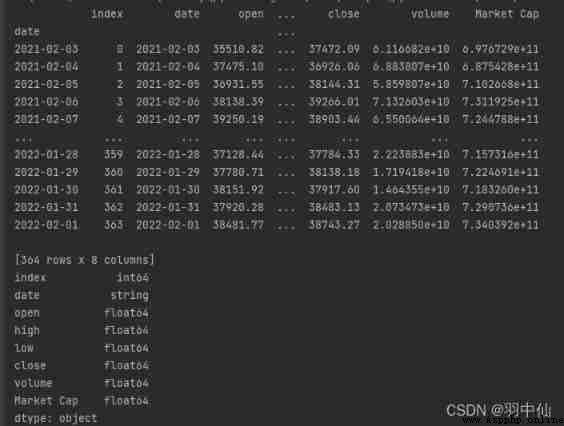

print(df)

print(df.dtypes)

df['date'] = df['date'].apply(lambda x: date2num(datetime.datetime.strptime(x, '%Y-%m-%d')))# Convert date format

print(df.dtypes)

print(df)

The output is as follows

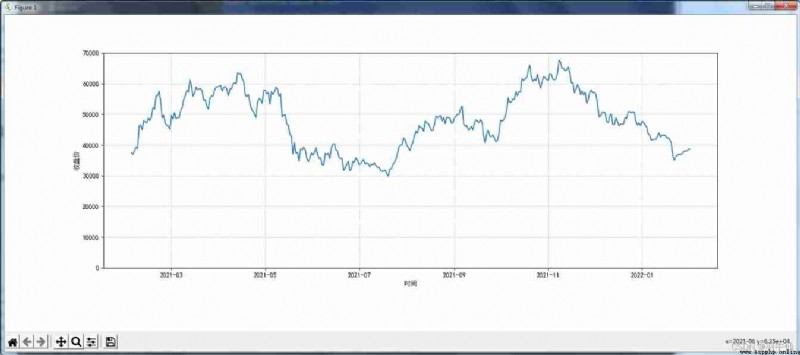

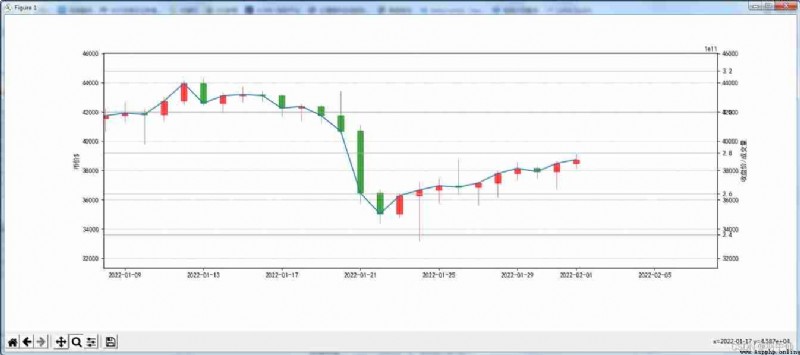

First on the renderings , Attached is the code that can be run directly ( The data is from the network disk data.txt)

Code

from lxml import etree

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

from mplfinance.original_flavor import candlestick_ohlc

from matplotlib.pylab import date2num

import datetime

with open("data.txt", "r") as f: rd = f.read()

selector = etree.HTML(rd)

url_infos = selector.xpath('//tr')

# from data.txt Extract the required data from

data = []

for url_info in url_infos:

l = []

# Obtain single line data and perform preliminary processing

for i in range(7):

d = url_info.xpath('td[%d+1]/text()' % i)

if i == 0:

l += d

else:

if d[0] == '-':

d[0] = np.nan

l += d

else:

d[0] = d[0].replace(',', '')

d[0] = d[0].strip('$')

d[0] = float(d[0])

l += d

data.append(l)

arr = np.array(data)

df = pd.DataFrame(arr) # Convert data to DataFrame data type

df.columns = ['date', 'open', 'high', 'low', 'close', 'volume', 'Market Cap'] # Set column title

# df['date']=df['date'].map(pd.to_datetime)# Convert date format

df = df.astype({

'open': 'float64', 'high': 'float64', 'low': 'float64', 'close': 'float64', 'volume': 'float64', 'Market Cap': 'float64'})

df = df.reindex(index=df.index[::-1])

df.head() # In reverse order

df.reset_index(drop=True, inplace=True) # After reverse order reset index

plt.rcParams['axes.unicode_minus'] = False# Solve the confusion of negative sign of coordinate axis scale

plt.rcParams['font.sans-serif'] = ['Simhei']# Solve the problem of Chinese garbled code

df.reset_index(inplace=True) # reset index, The original index Remittance DataFrame in

df['date']=pd.to_datetime(df['date'])

df = df.astype({

'date': 'string'})

df.index = pd.to_datetime(df['date']) # Set up index Value

print(df)

print(df.dtypes)

df['date'] = df['date'].apply(lambda x: date2num(datetime.datetime.strptime(x, '%Y-%m-%d')))# Convert date format

print(df.dtypes)

print(df)

fig, ax2 = plt.subplots(figsize=(1200 / 72, 480 / 72))

ax2.plot(df['date'], df['close'])

ax2.grid(True)

ax2.set_ylim(0, 70000)

fig.subplots_adjust(bottom=0.2) ## Adjust the bottom distance

ax2.xaxis_date() ## Set up X The axis scale is date time

plt.yticks() ## Set up Y Axis scale mark

plt.xlabel(u" Time ") ## Set up X Axis title

ax2.set_ylabel(' Closing price ')

plt.grid(True, 'major', 'both', ls='--', lw=.5, c='k', alpha=.3) ## Set gridlines

plt.show()

Here it is directly superimposed with the price chart to display

After zooming in, it looks like this :

from lxml import etree

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

from mplfinance.original_flavor import candlestick_ohlc

from matplotlib.pylab import date2num

import datetime

with open("data.txt", "r") as f: rd = f.read()

selector = etree.HTML(rd)

url_infos = selector.xpath('//tr')

# from data.txt Extract the required data from

data = []

for url_info in url_infos:

l = []

# Obtain single line data and perform preliminary processing

for i in range(7):

d = url_info.xpath('td[%d+1]/text()' % i)

if i == 0:

l += d

else:

if d[0] == '-':

d[0] = np.nan

l += d

else:

d[0] = d[0].replace(',', '')

d[0] = d[0].strip('$')

d[0] = float(d[0])

l += d

data.append(l)

arr = np.array(data)

df = pd.DataFrame(arr) # Convert data to DataFrame data type

df.columns = ['date', 'open', 'high', 'low', 'close', 'volume', 'Market Cap'] # Set column title

# df['date']=df['date'].map(pd.to_datetime)# Convert date format

df = df.astype({

'open': 'float64', 'high': 'float64', 'low': 'float64', 'close': 'float64', 'volume': 'float64', 'Market Cap': 'float64'})

df = df.reindex(index=df.index[::-1])

df.head() # In reverse order

df.reset_index(drop=True, inplace=True) # After reverse order reset index

plt.rcParams['axes.unicode_minus'] = False# Solve the confusion of negative sign of coordinate axis scale

plt.rcParams['font.sans-serif'] = ['Simhei']# Solve the problem of Chinese garbled code

df.reset_index(inplace=True) # reset index, The original index Remittance DataFrame in

df['date']=pd.to_datetime(df['date'])

df = df.astype({

'date': 'string'})

df.index = pd.to_datetime(df['date']) # Set up index Value

print(df)

print(df.dtypes)

df['date'] = df['date'].apply(lambda x: date2num(datetime.datetime.strptime(x, '%Y-%m-%d')))# Convert date format

print(df.dtypes)

print(df)

fig, ax1 = plt.subplots(figsize=(1200 / 72, 480 / 72))

da = df[['date', 'open', 'high', 'low', 'close']]

f = da[['date', 'open', 'high', 'low', 'close']].values

ax3 = ax1.twinx()

ax2 = ax1.twinx()

candlestick_ohlc(ax1, f, colordown='g', colorup='r', width=0.3, alpha=0.7)

ax3.bar(df['date'], df['volume'], width=0.6)

ax2.plot(df['date'], df['close'])

ax2.grid(True)

ax3.grid(True)

ax3.set_ylim(0, 500000000000)

ax1.set_ylim(0, 70000)

ax2.set_ylim(0, 70000)

ax1.set_ylabel(' The price of money $')

fig.subplots_adjust(bottom=0.2) ## Adjust the bottom distance

ax1.xaxis_date() ## Set up X The axis scale is date time

ax2.xaxis_date() ## Set up X The axis scale is date time

ax3.xaxis_date() ## Set up X The axis scale is date time

plt.yticks() ## Set up Y Axis scale mark

plt.xlabel(u" Time ") ## Set up X Axis title

ax2.set_ylabel(' Closing price / volume ')

plt.grid(True, 'major', 'both', ls='--', lw=.5, c='k', alpha=.3) ## Set gridlines

plt.show()

Here is a basic indicator : Simple moving average SMA( It is used to check the average price )

For details, please refer to this article :

https://zhuanlan.zhihu.com/p/422205612

For example :

Altogether 10 The closing price for consecutive days :1 2 3 4 5 6 7 8 9 10

I need a word 3SMA Line ( Namely 3 A simple moving average of three cycles )

Then I will get a group after 7 Day closing price 3SMA

(1+2+3)/3,(2+3+4)/3,…,(8+9+10)/3

Now I draw a 5SMA Graph ( The red line )

Calculation 5SMA Code for

step=5

dflen=len(df)

sma= {

}

for i in range(step):

sma[i]=0

for i in range(dflen-step):

i+=step

sma[i]=0

for j in range(step):

j+=1

sma[i] += df['close'][i-j]

if j==step: sma[i]=sma[i]/step

sma = pd.DataFrame.from_dict(sma,orient='index',columns=['SMA'])

print(sma)

Output the complete code of the picture

from lxml import etree

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

from mplfinance.original_flavor import candlestick_ohlc

from matplotlib.pylab import date2num

import datetime

with open("data.txt", "r") as f: rd = f.read()

selector = etree.HTML(rd)

url_infos = selector.xpath('//tr')

# from data.txt Extract the required data from

data = []

for url_info in url_infos:

l = []

# Obtain single line data and perform preliminary processing

for i in range(7):

d = url_info.xpath('td[%d+1]/text()' % i)

if i == 0:

l += d

else:

if d[0] == '-':

d[0] = np.nan

l += d

else:

d[0] = d[0].replace(',', '')

d[0] = d[0].strip('$')

d[0] = float(d[0])

l += d

data.append(l)

arr = np.array(data)

df = pd.DataFrame(arr) # Convert data to DataFrame data type

df.columns = ['date', 'open', 'high', 'low', 'close', 'volume', 'Market Cap'] # Set column title

# df['date']=df['date'].map(pd.to_datetime)# Convert date format

df = df.astype({

'open': 'float64', 'high': 'float64', 'low': 'float64', 'close': 'float64', 'volume': 'float64', 'Market Cap': 'float64'})

df = df.reindex(index=df.index[::-1])

df.head() # In reverse order

df.reset_index(drop=True, inplace=True) # After reverse order reset index

plt.rcParams['axes.unicode_minus'] = False# Solve the confusion of negative sign of coordinate axis scale

plt.rcParams['font.sans-serif'] = ['Simhei']# Solve the problem of Chinese garbled code

df.reset_index(inplace=True) # reset index, The original index Remittance DataFrame in

df['date']=pd.to_datetime(df['date'])

df = df.astype({

'date': 'string'})

df.index = pd.to_datetime(df['date']) # Set up index Value

print(df)

print(df.dtypes)

df['date'] = df['date'].apply(lambda x: date2num(datetime.datetime.strptime(x, '%Y-%m-%d')))# Convert date format

print(df.dtypes)

print(df)

step=5

dflen=len(df)

sma= {

}

for i in range(step):

sma[i]=0

for i in range(dflen-step):

i+=step

sma[i]=0

for j in range(step):

j+=1

sma[i] += df['close'][i-j]

if j==step: sma[i]=sma[i]/step

sma = pd.DataFrame.from_dict(sma,orient='index',columns=['SMA'])

print(sma)

fig, ax1 = plt.subplots(figsize=(1200 / 72, 480 / 72))

da = df[['date', 'open', 'high', 'low', 'close']]

f = da[['date', 'open', 'high', 'low', 'close']].values

ax3 = ax1.twinx()

ax2 = ax1.twinx()

axsma=ax1.twinx()

candlestick_ohlc(ax1, f, colordown='g', colorup='r', width=0.3, alpha=0.7)

ax3.bar(df['date'], df['volume'], width=0.6)

ax2.plot(df['date'], df['close'])

axsma.plot(df['date'],sma['SMA'],color="r")

ax2.grid(True)

ax3.grid(True)

axsma.grid(True)

ax3.set_ylim(0, 500000000000)

ax1.set_ylim(0, 70000)

ax2.set_ylim(0, 70000)

axsma.set_ylim(0, 70000)

ax1.set_ylabel(' The price of money $')

fig.subplots_adjust(bottom=0.2) ## Adjust the bottom distance

ax1.xaxis_date() ## Set up X The axis scale is date time

ax2.xaxis_date() ## Set up X The axis scale is date time

ax3.xaxis_date() ## Set up X The axis scale is date time

axsma.xaxis_date() ## Set up X The axis scale is date time

plt.yticks() ## Set up Y Axis scale mark

plt.xlabel(u" Time ") ## Set up X Axis title

ax2.set_ylabel(' Closing price / volume /SMA')

plt.grid(True, 'major', 'both', ls='--', lw=.5, c='k', alpha=.3) ## Set gridlines

plt.show()

Next, put 5SMA( Red ) 、30SMA( yellow )、 60SMA( green ) Reflect on a picture

2 The black arrow at the right shows A golden fork phenomenon often said in the stock market ( But I am a SMA Of ) The short term 5SMA With the long line 60SMA Cross the bottom up , Usually this is a buying signal ( At that time, it was a double offer , The actual combat can only be used as a reference point for judging the trend )

Finally, analyze this 2 month 3 In the future BTC Possible trends

You can see... In the picture The closing price line is in the middle 、 Below the long-term average , There will be a general trend of moving towards the average price , The buying opportunity should be 60SMA On 5SMA Progressive , Maybe a week or two There will be a cross trend

You should understand the role of indicators here The prediction is actually just to provide some data for you to judge , Indicators vary , Various stocks The monetary software needs the lines of various indicators Like MA EMA BOLL SAR Of Welcome to discuss and analyze , This article is also a little white Introduction , Let you understand The way data is transformed into pictures K Understanding of line diagram

Q149021708

from lxml import etree

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

from mplfinance.original_flavor import candlestick_ohlc

from matplotlib.pylab import date2num

import datetime

with open("data.txt", "r") as f: rd = f.read()

selector = etree.HTML(rd)

url_infos = selector.xpath('//tr')

# from data.txt Extract the required data from

data = []

for url_info in url_infos:

l = []

# Obtain single line data and perform preliminary processing

for i in range(7):

d = url_info.xpath('td[%d+1]/text()' % i)

if i == 0:

l += d

else:

if d[0] == '-':

d[0] = np.nan

l += d

else:

d[0] = d[0].replace(',', '')

d[0] = d[0].strip('$')

d[0] = float(d[0])

l += d

data.append(l)

arr = np.array(data)

df = pd.DataFrame(arr) # Convert data to DataFrame data type

df.columns = ['date', 'open', 'high', 'low', 'close', 'volume', 'Market Cap'] # Set column title

# df['date']=df['date'].map(pd.to_datetime)# Convert date format

df = df.astype({

'open': 'float64', 'high': 'float64', 'low': 'float64', 'close': 'float64', 'volume': 'float64', 'Market Cap': 'float64'})

df = df.reindex(index=df.index[::-1])

df.head() # In reverse order

df.reset_index(drop=True, inplace=True) # After reverse order reset index

plt.rcParams['axes.unicode_minus'] = False# Solve the confusion of negative sign of coordinate axis scale

plt.rcParams['font.sans-serif'] = ['Simhei']# Solve the problem of Chinese garbled code

df.reset_index(inplace=True) # reset index, The original index Remittance DataFrame in

df['date']=pd.to_datetime(df['date'])

df = df.astype({

'date': 'string'})

df.index = pd.to_datetime(df['date']) # Set up index Value

print(df)

print(df.dtypes)

df['date'] = df['date'].apply(lambda x: date2num(datetime.datetime.strptime(x, '%Y-%m-%d')))# Convert date format

print(df.dtypes)

print(df)

step=5

dflen=len(df)

sma= {

}

for i in range(step):

sma[i]=0

for i in range(dflen-step):

i+=step

sma[i]=0

for j in range(step):

j+=1

sma[i] += df['close'][i-j]

if j==step: sma[i]=sma[i]/step

sma = pd.DataFrame.from_dict(sma,orient='index',columns=['5SMA'])

print(sma)

step=30

dflen=len(df)

sma30= {

}

for i in range(step):

sma30[i]=0

for i in range(dflen-step):

i+=step

sma30[i]=0

for j in range(step):

j+=1

sma30[i] += df['close'][i-j]

if j==step: sma30[i]=sma30[i]/step

sma30 = pd.DataFrame.from_dict(sma30,orient='index',columns=['30SMA'])

print(sma30)

step=60

dflen=len(df)

sma60= {

}

for i in range(step):

sma60[i]=0

for i in range(dflen-step):

i+=step

sma60[i]=0

for j in range(step):

j+=1

sma60[i] += df['close'][i-j]

if j==step: sma60[i]=sma60[i]/step

sma60 = pd.DataFrame.from_dict(sma60,orient='index',columns=['60SMA'])

print(sma60)

fig, ax1 = plt.subplots(figsize=(1200 / 72, 480 / 72))

da = df[['date', 'open', 'high', 'low', 'close']]

f = da[['date', 'open', 'high', 'low', 'close']].values

ax3 = ax1.twinx()

ax2 = ax1.twinx()

axsma=ax1.twinx()

axsma30=ax1.twinx()

axsma60=ax1.twinx()

candlestick_ohlc(ax1, f, colordown='g', colorup='r', width=0.3, alpha=0.7)

ax3.bar(df['date'], df['volume'], width=0.6)

ax2.plot(df['date'], df['close'])

axsma.plot(df['date'],sma['5SMA'],color="red")

axsma30.plot(df['date'],sma30['30SMA'],color="blue")

axsma60.plot(df['date'],sma60['60SMA'],color="green")

ax2.grid(True)

ax3.grid(True)

axsma.grid(True)

axsma30.grid(True)

axsma60.grid(True)

ax3.set_ylim(0, 500000000000)

ax1.set_ylim(0, 70000)

ax2.set_ylim(0, 70000)

axsma.set_ylim(0, 70000)

axsma30.set_ylim(0, 70000)

axsma60.set_ylim(0, 70000)

ax1.set_ylabel(' The price of money $')

fig.subplots_adjust(bottom=0.2) ## Adjust the bottom distance

ax1.xaxis_date() ## Set up X The axis scale is date time

ax2.xaxis_date() ## Set up X The axis scale is date time

ax3.xaxis_date() ## Set up X The axis scale is date time

axsma.xaxis_date() ## Set up X The axis scale is date time

plt.yticks() ## Set up Y Axis scale mark

plt.xlabel(u" Time ") ## Set up X Axis title

ax2.set_ylabel(' Closing price / volume /SMA')

plt.grid(True, 'major', 'both', ls='--', lw=.5, c='k', alpha=.3) ## Set gridlines

plt.show()

To be continued …